The happenings and experiences of investors and traders for the past two weeks, in my humblest opinion, serves as an almost comprehensive trove of learning points to take home with, especially for those who are new to the markets, and for veterans relearning the basics.

While I can pick at least a dozen major and minor points to talk about, for this post I will select four which I deem them as important. I will also provide some links to my previous posts for detailed explanations on the points.

Learning Point #1: Everything Seems To Go Down

In times of market crisis, a common observation was that everything was going down, even safe assets such as gold. There are a few explanations, which I had covered here and here.

In gist, a lot of investors would want to preserve their capital by moving to safe assets, which may include bonds, commodities (gold in particular) and cash. The problem was that the vast quantum and speed of assets liquidated by so many people within a short time had caused demand and supply distortions, which in turn affected prices. Though equities were the hardest hit, there were also investors getting rid of the deemed safe assets, too, like bonds and gold, to hold onto the most liquid of them all: cash, before thinking of their next move.

After “Liberation Day” on 2 Apr 2025, gold went below USD 3,000 per oz before soaring to an all-time high again, which proved somewhat correct the points raised in the linked posts above.

Learning Point #2: No One Is Able To Predict The Markets

There are amateurs (retail investors and influencers), professionals (analysts and economists) and anyone in between that would constantly try to predict the market outcomes, with some backed-up by data and information, but no one is able to do it correctly. By prediction, what I meant was the ability to have the correct outcome at the correct time, right down to the ‘T’, and I dare say it is almost impossible to do it. Read this writeup for more details.

A related note to this point is that since no one knows how things would pan out, the things that was said by people in the media should be taken as opinions, not the truth, hence we should not be blindly following whatever was spoken.

Learning Point #3: Bottom Fishing

Rational investors would know the past two-week period as “the sale worth waiting for” and eagerly biding their time to purchase their targeted counters at their assumed right price. The ultimate prize would be going in at the “bottomest” price before shooting up again. Catching the bottom, though slightly easier than predicting, still requires sheer luck. Personally, I was able to sell a counter at its highest and bought another one at its lowest, both once, in my investing/trading life, and I attribute them solely to good luck, not acumen.

Rather than waiting to fish for the bottom, there are other methods in getting a counter near its lowest, where I had shared here.

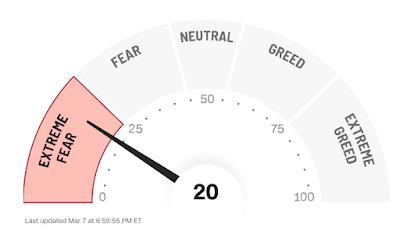

Learning Point #4: Keep Calm And Carry On Investing

This is self-explanatory, so I shall not say more.