The rise in interest rates in recent months has seen yet another rise in interest (pun intended) generated, based on what I have read online (yes, the Bedokian does scour the WWW for information) and offline amongst my friends, acquaintances and colleagues. First, there was (and still is) the hype over Singapore Savings Bonds, or SSBs (which I had written a piece here). The upcoming buzzword is “treasury bills”, or T-bills for short.

Introduction Of The T-Bill

In fixed income nomenclature, bills are debt instruments, issued by a government, whose duration is one year or less. Hence in layman speak, they are bonds with a very short term.

Due to this short-term nature, the coupon rate of a T-bill tends to be similar with the prevailing interest rate as at the time of the former’s issuance. With a tenure of one year or less, it is akin to a form of fixed deposit that you will find in banks. You could sell the T-bill on the open market before maturity, but it would be subject to market forces and you may profit or lose some amount, so it is recommended to hold it till maturity.

Under The Bedokian Portfolio’s classification, the T-bill belongs to the cash asset class due to its two main characteristics: the short duration and the positive correlation to prevalent interest rates, from which how cash derives its returns. Liquidity wise, it is easy to just sell it on the open market and get back the principal, though as mentioned in the previous paragraph there are market risks involved.

The Workings Of The T-Bill

Unlike other debt instruments, where the coupon is paid half yearly or annually, the T-bill’s coupon is paid upfront. T-bills are issued at a discount below par value, and the difference is the coupon/interest paid out. For example, I had applied for a one-year T-bill at the minimum bid of SGD 1,000, and after the closing of the application, the T-bill is issued at SGD 950, and I will get back the SGD 50. This SGD 50 is the coupon/interest for the T-bill, which the yield works out to be 5% (50/1000). When the T-bill matures, the full SGD 1,000 sum is returned.

For retail investors like you and me, Singapore T-bills can be applied using cash, Supplementary Retirement Scheme (SRS) account and Central Provident Fund (CPF) account through the three local banks: DBS, OCBC and UOB (note: you could sell your T-bills over the counter at either one of these three banks). Applications using cash and SRS can be done online or through the automated teller machines, while in-person applications are required at the bank where the CPF investment account is at.

Once you had settled on using cash, SRS or CPF, the next step is to bid (or auction) for the T-bills, which is a bit more technical as compared to applying for SSBs. There are two ways to bid for it, competitive or non-competitive. Competitive bidding is where you will input an annual yield number (in percentage and up to 2 decimal places) and that number signifies your lowest acceptable yield. In non-competitive bidding, you just accept whatever yield you are getting. From here, you can see that using a non-competitive bid can almost guarantee issuance, while a competitive bid depends on what yield number you put in; if your submitted number is higher than the result, you would not get the T-bill. If you are in the know and can roughly guesstimate the prevailing yield, then you may want to attempt a competitive bidding.

Unlike SSBs, where there is a consolidated limit of SGD 200,000 per individual, T-bills (and other Singapore government bonds) limits are much higher (at least SGD 1 million) for each issuance. Also, you can submit as many bids as you want, whether through non-competitive or a series of competitive bids with different yield numbers.

The Bedokian Getting The Feet Wet

We had recently applied for the 6-month T-bill (BS22115F closed on 4 Aug 2022) using cash and through UOB online banking (see Figure 1). One non-competitive bid and one competitive bid (bid at 2.8%) were submitted for SGD 1,000 each (see Figures 1.1 and 1.2 respectively):

Fig. 1

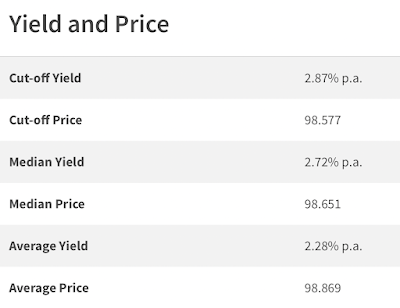

Here is an excerpt of the results of the T-bill BS22115F from the Monetary Authority of Singapore (MAS) website (Figure 2):

Fig. 2

There are many numbers, but just look at the first two rows will do: the cut-off yield is applicable to competitive bids, where if you submitted any number above that, the bid is out. The cut-off price is the eventual amount of the T-bill, which is 98.577 (remember the T-bill is issued below the par value of SGD 1,000). Multiply this number by 10 and your T-bill is worth SGD 985.77, and the amount of SGD 1,000 – SGD 985.77 = SGD 14.23 is the coupon/interest.

Both of our bids were successful, and we had 2 x SGD 14.23 refunded on 4 Aug 2022 (see Figure 3). This refund is also the T-bill coupon/interest amount.

Fig. 3

Since this is a cash application, the T-bills appeared in the Central Depository account on 10 Aug 2022 (Figure 4).

Fig. 4

Conclusion

Even if not for investment purposes, the T-Bills are another good alternative to store your cash which you foresee not using for at least the next six months to a year.

References:

https://www.mas.gov.sg/bonds-and-bills/Singapore-Government-T-bills-Information-for-Individuals