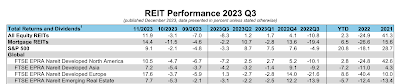

There are three bond classes in the Astrea 9 series, with two classes (A-1 and A-2) available for retail investors. Figure 1 provides a brief of the two.

Fig.1: Information of the Astrea 9 A-1 and A-2 bond classes. Screenshot from Azalea website.

The Astrea 9 Transaction Portfolio, from which it derives the cash flow for the bonds, is made up of 40 PE funds managed by 31 General Partners and across 1,086 investee companies. These investee companies are diversified across:

- Sectors (31% in information technology, 21% in industrials, 15% in health care, and the rest across other sectors such as financials, communication services, etc.)

- Geographically (66% in the United States, 26% in Europe and 8% in Asia)

- Fund Age (between three and eight years, with the five-year and six-year making up 52%)

As seen in Figure 2, A-1 and A-2 bondholders are relatively high up in the receipt of distributions (Clause 5).

Fig. 2: Astrea 9 cash flow and priority of payments. Screenshot from Azalea website.

The Rates

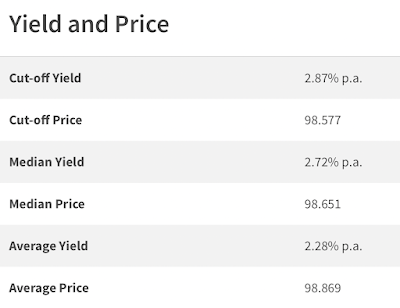

The annual interest rates (or coupon rates) for A-1 and A-2 are 3.4% and 5.7% respectively. Like the previous Astrea bonds, the rate for US$ denominated bonds are higher to compensate for the forex risk vis-à-vis against the S$. With the US$ depreciating against S$ by around 5.8% for the past five years, and we do not know how the US$-S$ forex rate would be, it is usually prudent to stick to local currency for fixed income instruments.

Perhaps the major consideration of investing in corporate bonds would be comparing with the (relatively) risk-free rate of Singapore government bond yields for the same duration. With the Astrea 9 bonds having the earliest callable date in five years and the maturity date 15 years later, and using the current Singapore government 5-year and 15-year bond yields at 1.8%1 and 2.21%2 respectively, the 5-year risk premium is 1.6% (3.4 – 1.8) while the 15-year risk premium is 2.19% (3.4 + 1 (step-up) – 2.21).

The Bedokian’s Take

The Bedokian Portfolio’s bond selection entails the bond to be at least of investment grade and five years to maturity3, to which both A-1 and A-2 met the mark.

The low risk premium may be slightly uncomfortable for some conservative investors, since there is a very remote chance of the bond defaulting on the coupon payments and principal. So far, the retail tranches of past and current Astrea bonds (IV, V, VI, 7 and 8) have/had paid regular coupons on time, with no impairment of the principal.

With Singapore Savings Bond and bank fixed deposit rates going down, many investors may go for this as the next deemed “fixed deposit”, though I would caution it is still a listed instrument subjected to price and market volatility.

The offer period for the bond is from now till 1200 hrs, 6 Aug 2025.

Reference

Astrea 9 Bond Prospectus - https://www.azalea.com.sg/sites/default/files/2025-08/astrea-9-pte-ltd-prospectus-30-july-2025.pdf

1 – Singapore 5 Year Bond Yield. Trading Economics. 1 Aug 2025. https://tradingeconomics.com/singapore/5-year-bond-yield

2 – Singapore 15 Year Bond Yield. Trading Economics. 1 Aug 2025. https://tradingeconomics.com/singapore/15-year-bond-yield

3 – The Bedokian Portfolio (2nd ed), p108.