Apart from commodities and cash, the Bedokian way of diversification, if it is to be done, is from top to bottom: asset class, region/country and then to sector/industry. Some of you may be wondering, why the further diversification below asset class has to be in that order.

Region/Country

Generally, an asset class in a region or country will perform differently from another. For instance, the table below shows the stock market (i.e., mainly of equities asset class) returns of various countries between 2009 and 2023 (Figure 1):

Fig.1: International Stock Market Returns, 2009 to 2023. Source: Novel Investor (www.novelinvestor.com). Click to enlarge.

Looking at some years, we had the extreme case of 2015 where the Danish index gained 24.4% while the Canadian index dropped 23.6%. In the year 2018 which all indices were negative, the Finnish one was only down by 2.2% while the Austrian one suffered -27.1%.

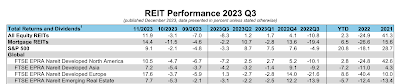

The same goes for real estate investment trusts (REITs). According to data from NAREIT (Figure 2), for the regions of North America, developed Asia, developed Europe and emerging real estate showed different returns for the years 2021, 2022 and 2023.

Fig.2: Excerpted from REIT Performance 2023 Q3, with 2021, 2022 and 2023 YTD shown in last three columns. Source: NAREIT Quarterly REIT Performance Data (www.reit.com). Click to enlarge.

Bonds wise, using another matrix of different regions/countries (Figure 3), the differing results were like that of equities’ in Figure 1:

Fig.3: Fixed Income Country Returns, USD Hedged, 2009 to 2022. Source: Alliance Bernstein and Bloomberg (www.alliancebernstein.com). Click to enlarge.

As what the heading said in Figure 3, no country wins all the time.

Sector/Industry

Why and how each region/country’s asset classes behave differently is very much impacted by the next layer of diversification, that is sector/industry. The proportions of the sectors/industries are different in the economies of various regions and countries, and this in turn drives the outcome of returns of that area. Socioeconomic, geopolitical, and regulatory factors also play a part in the overall scheme of things. Thus, Country A’s banking sector may thrive more than Country B’s; Country C’s property market is worse off than Country D’s, and Country E’s government bonds are higher yielding than Country F’s due to the former’s lower ratings.

Putting it to real life examples, Figure 4 shows the comparison between the United States (US) and China healthcare sector, with convergences and divergences throughout a 10-year period. Another reality is on REITs where US office property sector is facing a crisis whilst Singapore’s are having a better outlook, so far.

Fig.4: 10-Year Comparison between US Health Care Select Sector Index and S&P China A 300 Health Care (Sector) Index (USD). Source: S&P Global (www.spglobal.com).

Exception: Thematic Investing

The main exception to the above diversification order is thematic investing. Blending both region/country and sector/industry, exchange traded funds (ETFs) that use thematic investing tend to bundle in companies from sectors/industries that are part of the theme, regardless of their nation of origin. Using an ETF which we are vested, the iShares Global Clean Energy ETF (ICLN)1, it contains companies from the information technology, utilities, industrials, etc. sectors/industries from countries such as the US, China, Denmark, India, etc.

Disclosure

The Bedokian is vested in ICLN.

1 – iShares Global Clean Energy ETF. iShares. https://www.ishares.com/us/products/239738/ishares-global-clean-energy-etf (accessed 31 Mar 2024)

No comments:

Post a Comment