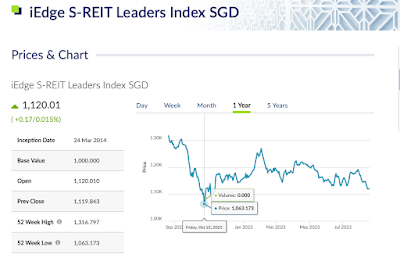

The Singapore REITs (S-REITs) seems to be heading for a winter. I had written a piece “Are REITs Doomed?” here back on 23 October 2022. Coincidentally, based on the iEdge S-REIT Leaders Index1, it had bottomed out just two days before the above post was published, before starting its recovery to the next one-year high at around early February 2023 (see Figure 1). Now, looking at Figure 1, you could see that the index is heading downwards again, sparking an early winter in 2023.

Fig. 1: iEdge S-REIT Leaders Index SGD, 1 year chart (as of 20 Aug 2023)

For myself, these down periods constituted a sales period when you could get counters at a discount. However, due to the economic situation of high interest rates, and properties are not doing well in most countries, we need to be selective on getting good, discounted REITs.

The following are what I am looking at. Do note that we have these counters in our portfolio and we are looking at averaging up/down on these counters.

REIT #1: Frasers Centrepoint Trust

Frasers Centrepoint Trust (FCT) has in its portfolio 9 suburban malls concentrated in the northern, northeastern and eastern part of Singapore, where there are a good proportion of residential towns (Hougang, Tampines, Punggol, etc.). We had seen the resiliency of suburban malls as gathering points for residents, and during the COVID-19 pandemic restrictions.

Though the gearing as of May 20232 stood at 39.6%, 76.4% of the debt was hedged to fixed interest rate, and that meant there is a higher stability of interest payments. Net property income had seen a 5.7% rise year-on-year between 1H2023 and 1H2022, and at its current price of SGD 2.19 as of 20 Aug 2023 represented 0.94% of its net asset value (NAV) of SGD 2.333.

As FCT is currently close to 11% of our portfolio holdings, we would still add but not many of this counter.

REIT #2: Paragon REIT

Singapore properties made up about 80% of Paragon REIT by valuation, and the crown jewel is the Paragon located in the heart of Orchard Road, which is both a luxury shopping mall and a hub of medical offices. With the return of tourism and increasing number of family offices with affluent clients, I foresee Paragon would be one of the important stops for these groups. In addition, suburban Clementi Mall’s location next to a MRT station and its near-monopolistic catchment area is attractive.

Having a gearing of 29.8%, it is one of the lowest geared S-REIT around, and 85% of the debt is on a fixed rate. Trading at SGD 0.905, it is slightly above the NAV of SGD 0.904. The only gripe we had would be a lowering of income from the Australian properties due to the strengthening of SGD against the Australian dollar, but going forward these may be compensated with higher income from the three Singapore properties.

REIT #3: Frasers Logistics & Commercial Trust

Unlike the previous two, Frasers Logistics & Commercial Trust (FLCT) is made up of 99 logistics and 8 commercial properties spread across Australia, Singapore, Germany, the United Kingdom and the Netherlands. FLCT’s logistics and industrial/commercial ratio by portfolio value is around 68/32, and the logistics and industrial component enjoyed a 100% occupancy rate, with the commercial side at 90.6%, bringing to the average across the REIT at 96.2%5.

The main advantage of logistics and industrial sectors is that work from home does not really work since the goods and/or processes are to be housed in a physical property. The resumption of the global supply chain after the COVID-19 slowdown bode well for FLCT, too. The occupancy rate for the commercial portion, however, especially the United Kingdom properties, were not faring well (due to the work from home phenomenon). This is one point which I would revisit in the future, as well as their net property income which declined due to the strong SGD against the countries’ currencies where the properties are located.

At a gearing of 28.6% (lower than Paragon’s), with 75.4% debt at fixed rates, a high interest coverage ratio of 8x, and trading at 92% of its NAV (NAV of SGD 1.276 vs current market price of SGD 1.17), FLCT would be in our watchlist.

Disclosure

The Bedokian is vested in all the abovementioned REITs.

1 – iREIT S-REIT Leaders Index SGD. SGX. https://www.sgx.com/indices/products/sreitlsp (accessed 20 Aug 2023).

2 – Frasers Centrepoint Trust Investor Presentation. May 2023. https://fct.frasersproperty.com/newsroom/20230509_073050_J69U_2IOJH8M54D407LB0.1.pdf (accessed 20 Aug 2023)

3 – Frasers Centrepoint Trust Annual Report 2022, p5 & p38. https://fct.frasersproperty.com/misc/ar2022.pdf(accessed 20 Aug 2023)

4 – Paragon REIT 1H FY2023 Financial Results. 7 Aug 2023. https://paragonreit.listedcompany.com/newsroom/20230807_193701_SK6U_C6Z3UOZ9XDMFOJO8.3.pdf(accessed 20 Aug 2023)

5 – Frasers Logistics & Commercial Trust 3QFY23 Business Update. 1 Aug 2023. https://flct.frasersproperty.com/newsroom/20230801_182514_BUOU_JZOH13NA5MBT4DKV.1.pdf (accessed 20 Aug 2023)

6 – Frasers Logistics & Commercial Trust 1HFY23 Results Presentation, p7. 4 May 2023. https://flct.frasersproperty.com/newsroom/20230504_070810_BUOU_BDL2BIU72TTDX75W.3.pdf (accessed 20 Aug 2023)

No comments:

Post a Comment